Facts About Paypal Business Loan Revealed

Wiki Article

Indicators on Paypal Business Loan You Need To Know

Table of ContentsFascination About Paypal Business LoanThe Best Guide To Paypal Business LoanHow Paypal Business Loan can Save You Time, Stress, and Money.The 7-Second Trick For Paypal Business LoanThe Main Principles Of Paypal Business Loan The Facts About Paypal Business Loan RevealedThe 15-Second Trick For Paypal Business LoanThe Of Paypal Business LoanThe Only Guide to Paypal Business Loan

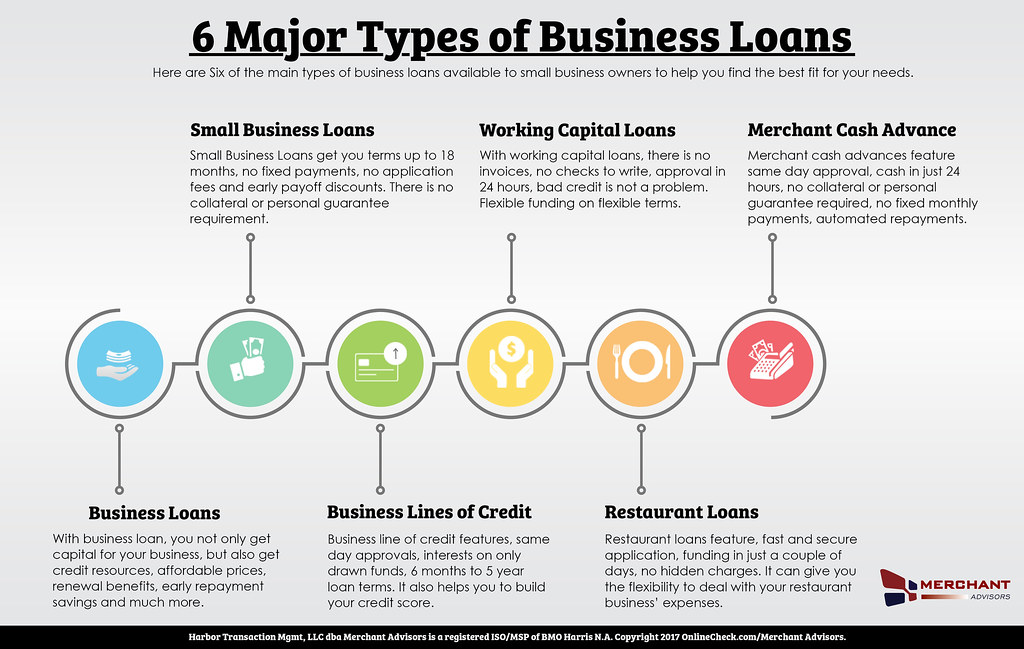

There are various type of bank loan, making it necessary to do your research study prior to starting any kind of application procedure. Hurrying the procedure belongs to strolling into a paint shop and also informing the clerk you require a container of paint, any kind will certainly do. You 'd wind up driving residence with a brand-new canister of paint, however it's unlikely you would certainly get the one required for your details task.If your objective for the money isn't clear, it's secure to claim you have work to do prior to knocking on a lending institution's door. Create a solid strategy, and after that establish the particular amount of cash needed to make it take place. Likewise think about the length of time you would like to have to pay the cash back.

What Does Paypal Business Loan Do?

Take note of the dollar quantities, prices, terms, and also other aspects, as they resemble the product details in the paint shop that will help you select the tiny business funding type that's completely matched for your company requirements. When adaptability is a top priority, think about a company line of credit scores. You can get anywhere from $1,000-$500,000, and also the money is commonly available in a week or two.If you have actually stayed in business for over half a year, are generating $50,000 or more in annual income, and have a credit rating of 560 or greater, consider on your own a prime prospect. As component of the application procedure, a lending institution might require you to make a personal warranty.

How Paypal Business Loan can Save You Time, Stress, and Money.

Instead, it assures a significant part of each funding, which minimizes other lenders' threat and makes them much more willing to accept your request (PayPal Business Loan). The SBA supplies a range of fundings to tiny business owners. Here are a few of the most prominent options: This car loan is one of the most looked for after and can be made use of for all sort of functions.

Getting The Paypal Business Loan To Work

As long as you have actually obtained healthy and balanced credit score and have been in company for at the very least a couple of years, you'll remain in good condition. Sometimes, the lending institution might require you to protect the financing with some individual collateral (PayPal Business Loan). Common instances of security include a house, truck, or property home.Much better yet, the rates of interest start as low as 6%. These lendings have a set rate of interest or level cost, so the payments will certainly never go up throughout the life time of the finance. A significant advantage of this finance is it's easier for you to determine just how much you can manage to obtain, while likewise making it much less difficult to repay.

5 Simple Techniques For Paypal Business Loan

You can look for anywhere from $5,000 to $200,000, and also time to funds can be as short as 24 hrs. This kind of convenience comes at a premium rate, and you can anticipate the passion recommended you read prices to begin around 18%. Getting a seller cash money development is remarkably straightforward since the nature as well as terms of the finance make the threat reduced for a lending institution.The factor is, if the acquisition will certainly help to equip your company for its demands, it probably satisfies the standards. One wonderful point about this kind of bank loan is that you can access the cash rapidly. After submitting your application, you might see funds in as little as 24 hr.

4 Simple Techniques For Paypal Business Loan

If you 'd like to build, you can use a business home mortgage to pay for the building and construction costs. For those seeking to expand their existing property, you can utilize it to include square video. As well as if you're functioning with an older area that requires some upgrading, such a restaurant or retail shop, this funding can be simply the ticket.

This funding option is an asset-based funding, so the amount and price of your business home loan will certainly be based on your credit rating as well as the worth of the residential or commercial property you'll be utilizing as collateral. You can anticipate amounts varying from $250,000 to $5,000,000. The rate of interest are normally on the reduced end, beginning around 4.

Examine This Report on Paypal Business Loan

One of the primary advantages of receivables funding is it alleviates you of the problem of locating those who owe you cash to accumulate on the arrearages. Instead, the lender will certainly do the dirty work for you. Another vital benefit is you can certify also if your credit history is less-than-great.

All About Paypal Business Loan

So if your debtors have excellent debt, the factoring firm will certainly consider it likely that they'll compensate, meaning they'll be extra ready to have you move the invoice to them. Your credit rating, in the meanwhile, remains mostly out of the image. Also, balance dues financing doesn't need you to present Continued any type of security.You can hold on to all your individual items as well as not need to stress about putting them in jeopardy at any type of time. The issue that business owners run into is that some kinds of little service lendings call for a significant company history to qualify.

Get This Report about Paypal Business Loan

Report this wiki page